how to calculate a stock's price

The closing price of stock A in the above example is not Rs. Enter the purchase price per share the selling price per share.

Quarterly Average Balance Meaning Calculation Average Meant To Be Balance

User buys 5 shares of stock S at 25 per share.

. Below are the equations to calculate the intrinsic value of a call or put option. Using the example above. Common Stock Splits An easy way to determine the new stock price is to divide the previous stock price by the split ratio.

Access the Nasdaqs Largest 100 non-financial companies in a Single Investment. In this case the adjusted closing price calculation will be 20 1 21. But you have faith that it will go upwards in future.

This will give you a price of 667 rounded to the nearest penny. Stock Price 300 105 1 008 10800 108 100. When Benjamin Graham Formula formula is used to Heromoto the Graham number is as follows.

You now have your average purchase price for your stock position. Additionally look at how the stock has done year to. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

The total volume is 100. In this case the closing price will be calculated by dividing the total product 1872 by. If the strike price is equal to the stocks price in the market the option is said to be at-the-money.

Divide the total amount invested by the total shares bought. Graham Number Square root of 1853 x 15 14839 x 184079 2755. You want to reduce the average stock price by buying more stocks but you need to calculate.

To find the market price per share of common stock divide the common stockholders equity by the average number of outstanding common stock shares. 56 as per the last trade. Enter the number of shares purchased.

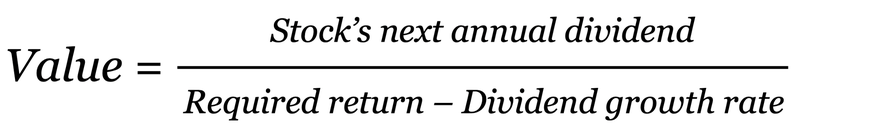

The Stock Calculator is very simple to use. Ad Trade on One of Three Powerful Platforms Built by Traders For Traders. A stocks annual dividend should be easy enough to find on any stock quote and for the purposes of this calculation its fair to assume the historical dividend growth rate will.

Just follow the 5 easy steps below. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. We Pledge To Deliver Service Support To Meet the Unique Needs of Advisors We Serve.

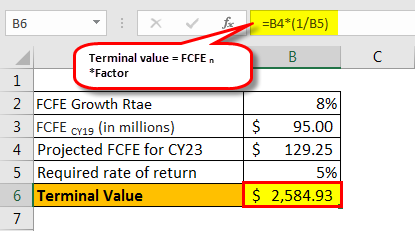

The net movement resulting from this would be 5100 25 0125. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Terminal value will be 3 times the final Year 5 value which comes to 2265 million.

How do you calculate stock splits. Using the average down calculator the user can calculate the stocks average price if the investor bought the stock differently and with other costs and share amounts. You can also figure out the average purchase price for each investment by dividing the amount invested by the shares.

Ad We Provide Industry-Leading Custody Services With No AUM Minimums and No Custody Fees. Now the stock price has gone down to 150. Consider the actual performance of the stock over a period as though you had invested in it on that first day of the period.

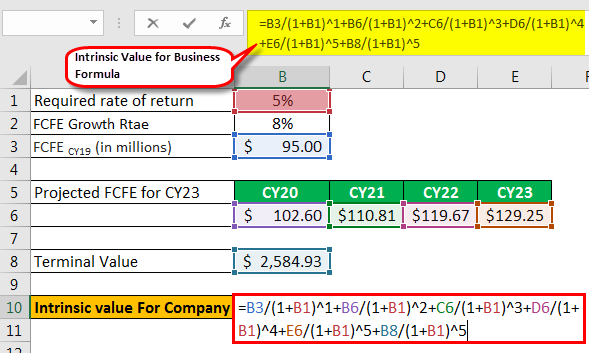

To reach the net present value take the sum of these discounted cash flows. So the after this trade the new stock price is. Averaging down is an investment strategy that involves buying.

Announces a 21 stock. Ad See how Invesco QQQ ETF can fit into your portfolio. Some individuals may recognize this stock price calculation as the beginnings of a discounted cash flow.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. What does it mean to average down a stock.

Gordon Growth Model Definition Example Formula Pros Cons

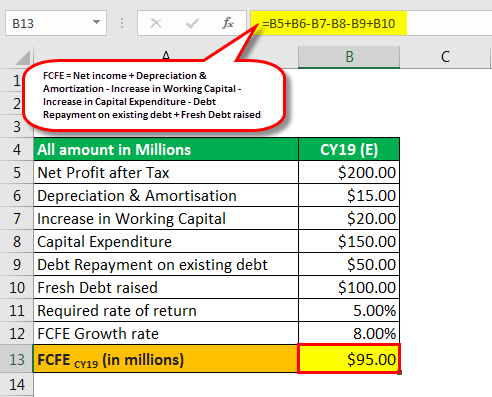

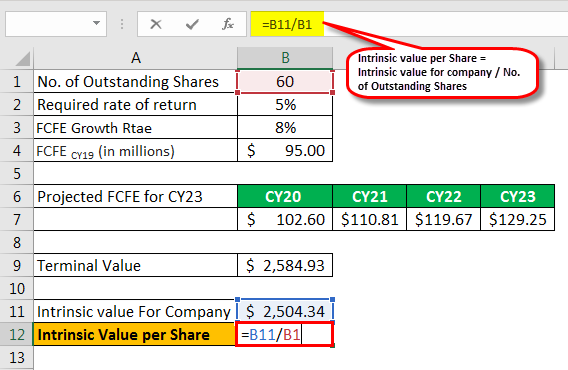

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Exactly How Is The Closing Price Of A Stock Calculated Quora

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Calculating Return On Investment Roi In Excel

Distance Formula Chilimath Distance Formula Midpoint Formula Math Videos

Calculating The Probability Of A Stock Reaching A Given Price In A Specified Time Window In Excel Youtube

A Short Guide To Stock Investing Musing Zebra Investing In Stocks Investing Guide

Dividend Yield Formula With Calculator

Mathematically Calculating 1sd Expected Move Using A Probability Analysis Chart Nisha Trades

Calculate Monthly Returns On Stocks In Excel Financial Modeling Tutorials

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Lookup Historical Stock Split Data For Specific Stocks Starbucks Stock Company Names First Site

Equity Risk Premium Erp Formula And Excel Calculator

Stock Investment Calculator Calculate Dividend Growth Model Err

:max_bytes(150000):strip_icc()/dotdash_Final_Multiple_Nov_2020-01-5cc7fb72038d42a7a9ea850d8b4c2208.jpg)

/dotdash_Final_Multiple_Nov_2020-01-5cc7fb72038d42a7a9ea850d8b4c2208.jpg)