san antonio sales tax rate 2021

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio. CITY OF SAN ANTONIO.

Understanding California S Sales Tax

Fill in price either with or without sales tax.

. The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. San antonio sales tax rate 2021 Sunday March 20 2022 Edit. While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected.

0125 dedicated to the City of San Antonio Ready to Work Program. Taxing unit officials must adhere to specific procedures established in Truth and Taxation Laws when they adopt tax rates. There is no applicable city tax or special tax.

San Antonio TX 78205 Phone. 4 rows The current total local sales tax rate in San Antonio TX is 8250. 2021 Official Tax Rates.

The rate of revenue growth projected in FY 2022 over the FY 2021 Adopted Budget is a 32 increase. US Sales Tax Texas Bexar Sales Tax calculator San Antonio. The Texas state.

The FY 2021 Revenue Estimate is approximately 424000 higher than the FY 2021 Adopted Budget or an overall increase less than 01. 1000 City of San Antonio. Does Texas have sales tax.

The County sales tax rate is. 0500 San Antonio MTA Metropolitan Transit Authority. Calculator for Sales Tax in the San Antonio.

It is a 022 Acres Lot 1596 SQFT 3 Beds 2 Full Baths in San Antonio. San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2. The citys proposal would train 40000 job-seekers for new careers.

The state sales tax rate in Texas is 6250. The minimum combined 2022 sales tax rate for San Antonio Texas is. The Bexar County sales tax rate is.

Bexar County collects on average 212 of a propertys assessed fair market value as property tax. Monday-Friday 800 am - 445 pm. Method to calculate San Antonio Heights sales tax in 2021.

2021 Official Tax Rates Exemptions. This increase is primarily due to city sales tax outperforming projections. The 2018 United States Supreme Court decision in South Dakota v.

This rate includes any state county city and local sales taxes. The results are rounded to two decimals. How Does Sales Tax in San Antonio compare to the rest of Texas.

The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. 05 lower than the maximum sales tax in FL. There is no applicable city tax or special tax.

0125 dedicated to the City of San Antonio Pre-K 4 SA initiative. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. The San Antonio Texas sales tax is 625 the same as the Texas state sales tax.

Thursday July 01 2021. 2020 Official Tax Rates Exemptions. 4 rows The current total local sales tax rate in San Antonio TX is 8250.

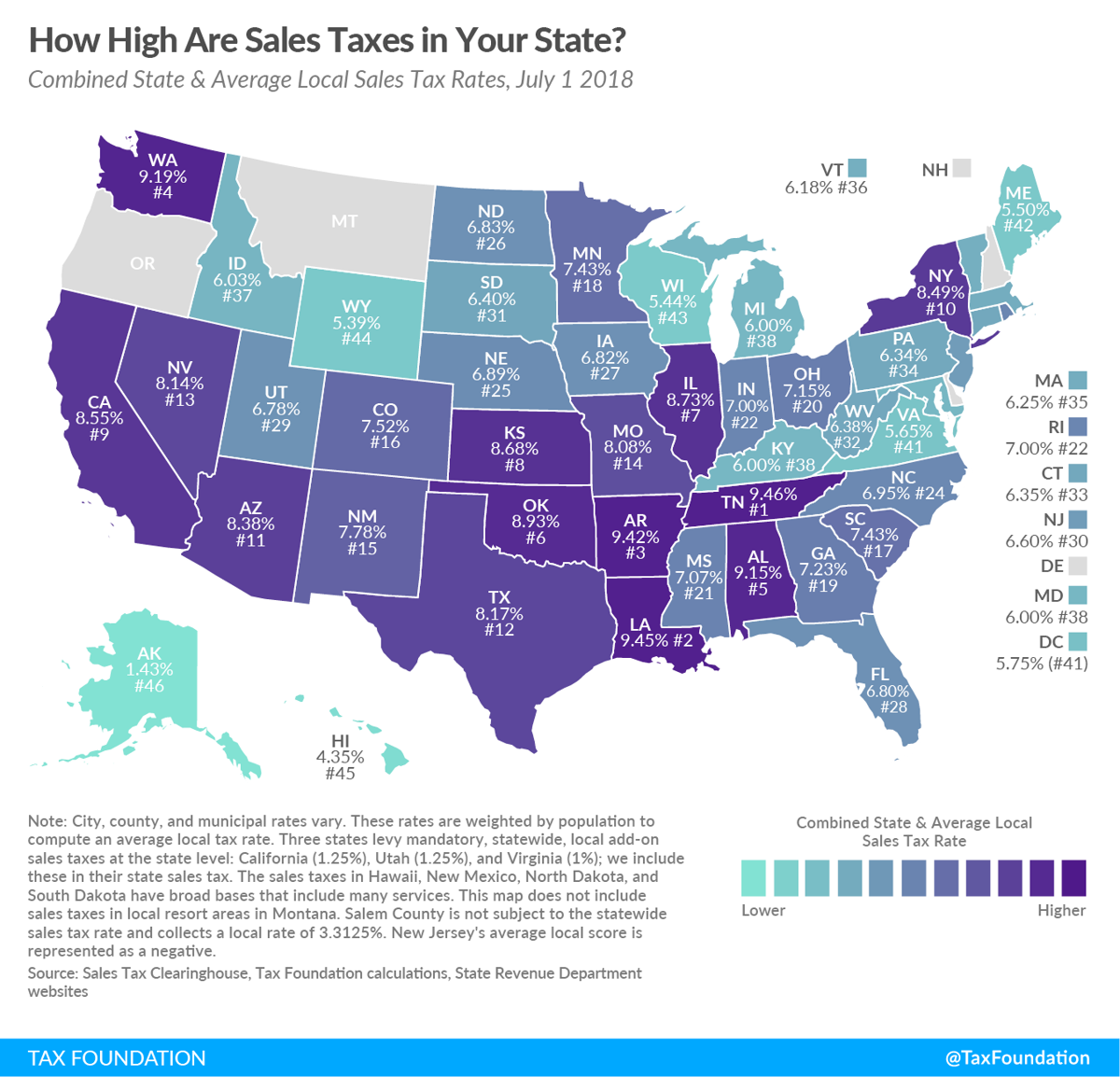

State State Sales Tax Rate Rank Avg. Counties cities and districts impose their own local taxes. There is base sales tax by Texas.

Select the Texas city from the list of popular cities below to see its current sales tax rate. The Texas sales tax rate is currently. What is the sales tax rate in San Antonio Texas.

0250 San Antonio ATD Advanced Transportation District. With local taxes the total sales tax rate is between 6250 and 8250. The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio.

The San Antonio Texas sales tax is 625 the same as the Texas state sales tax. The County sales tax rate is. Texas has recent rate changes Thu Jul 01 2021.

1000 City of San Antonio. 911 Camden St San Antonio TX 78215 is listed for sale for 535000. The Texas sales tax rate is currently.

0 San Fidel Way is a property in San Antonio TX 78255. The December 2020. The Texas state sales tax rate is currently.

For tax rates in other cities see Florida sales taxes by city and county. You can find more tax rates and allowances for San Antonio and Texas in the 2022 Texas Tax Tables. As of 1232021 91118 pm you can obtain your san antonio sellers permit here at 39 plus any tax you may hav.

You can print a 7 sales tax table here. This is the total of state county and city sales tax rates. San Antonios current sales tax rate is 8250 and is distributed as follows.

The 7 sales tax rate in San Antonio consists of 6 Florida state sales tax and 1 Pasco County sales tax. The San Antonio sales tax rate is. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

The minimum combined 2022 sales tax rate for Bexar County Texas is. The minimum combined 2021 sales tax rate for san antonio texas is. 2021 Official Tax Rates Exemptions Name Code Tax.

Ad Lookup TX Sales Tax Rates By Zip. The average sales tax rate in California is 8551. San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2.

The process used is dependent on benchmark rates known as the effective tax rate and the rollback rate. Texas has a statewide sales tax rate of 625 which has been in place since 1961Municipal governments in Texas are also allowed to collect a local-option sales tax that ranges from 0 to 2 across the state with. The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio.

This is the total of state and county sales tax rates. Popular Counties All A B C D E F G H I J K L M N O P Q R S T U V W Y Z. Sales and Use Tax.

Free Unlimited Searches Try Now. Did South Dakota v. Did South Dakota v.

Has impacted many state nexus laws and sales tax.

New Mexico Sales Tax Rates By City County 2022

Texas Car Sales Tax Everything You Need To Know

Understanding California S Sales Tax

Tennessee Now Has The Highest Sales Tax In The Country Pith In The Wind Nashvillescene Com

Understanding California S Sales Tax

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Vape E Cig Tax By State For 2022 Current Rates In Your State

Is It Possible To Buy A New Apple Device Without Any Sales Tax Appletoolbox

Sales Tax Rates In Major Cities Tax Data Tax Foundation

How To Calculate Sales Tax On Almost Anything You Buy

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Understanding California S Sales Tax

Texas Sales Tax Guide And Calculator 2022 Taxjar

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Tobacco Cigarette Tax By State 2022 Current Rates In Your Jurisdiction

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation